M&A Support

M&A transactions are addressed as an extremely important strategy for corporate growth initiatives. In order to soundly achieve the targets originally planned for an M&A, preliminary study and due diligence are essential in the M&A transaction process. Also, the integration process after an M&A is another important element. From preparation phase to integration phase of M&A transaction, we extensively support the process to succeed management strategies.

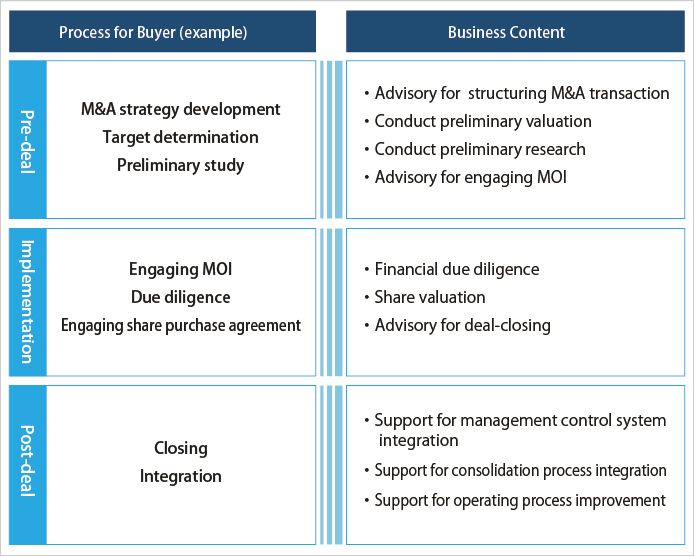

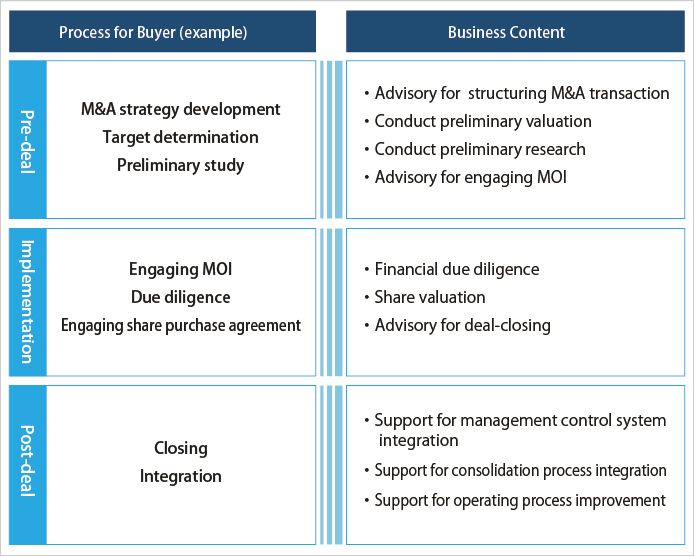

Typical example of M&A processed at buyers are as follows:

■ Pre-deal

As a part of business strategies, target business for acquisition will be selected from the lists of potential targets by proceeding with preliminary information analysis, predicted synergy analysis, provisional value measurement, and M&A structure examination.

Following the above step, MOU (Memorandum of understandings, or letter of intend) will be engaged through negotiation of the conditions for acquisition based on the preliminary information analysis, provisional value measurement, etc.

In the pre-deal phase, we will support the M&A transaction by studying M&A structures, conducting provisional value measurement, conducting preliminary information analysis, and advising on engaging MOU.

■ Implementation phase

In the implementation phase, after concluding MOU as well as non-disclosure agreements, due diligence will be conducted. In the due diligence process, in order to understand the underlying risks of the M&A transaction in relation to business, law, finances, and taxes, the project team of the buyer entity will proceed with due diligence on each area by using external specialists.

After that, the identified risks by the due diligence process will be discussed in order to minimize such risks by reflecting to the acquisition price or modifying acquiring conditions of the M&A transaction. And where reaching to agreements following the negotiation, purchase agreements will be concluded.

In the implementation phase, we will provide dedicated financial due diligence services, share valuation services and advisory services for deal closing in order to succeed the transactions.

■ Post-deal/Integration process

The integration process following M&A transaction is an extremely significant process to run the acquired business smoothly and maximizing its value under the new management system.

In the integration process, we will support for the integration of management control system, improving operating control system and monitoring over management improvements.

We will extensively support the success of your business through a series of M&A transaction processes.

Sell-Side Support

In terms of the support for deals at seller side, we also provide following professional supports:

■ Conduct sell-side due diligence

■ Support for development possible queries upon buyer due diligence